I’m a huge proponent of Bitcoin and a supporter of the community as a whole.

Bitcoin

That being said, I think it’s important to take an objective look at the points being made by anti-Bitcoin groups. It’s also important to scrutinize the claims being made by the Bitcoin community itself about how the cryptocurrency is going to change the world.

To keep things simple, I’ve broken down each major argument against Bitcoin and responded to each criticism in turn.

1. The distribution dilemma

One of the promises of cryptocurrencies is s their ability to distribute wealth more evenly across the world, disrupting the current inequality of wealth. In fact, author Don Tapscott argues that the rise of blockchain technology has presented us with a unique opportunity to pre-distribute wealth.

These are big claims.

And when you look at some of the models for introducing a new cryptocurrency into the world, it’s clear that there’s some truth in the idea that they’ll help create a fair distribution of wealth. For example, Initial Coin Offerings (ICOs) have enabled anybody to become an angel investor. Before the ICO model was introduced, early investments in companies were only available to individuals and organizations with access to a significant amount of capital.

A system that cuts those who aren’t already wealthy off from these investment opportunities perpetuates inequality.

The rich get richer while the poor are denied the chance to get their foot in the door. The idea behind ICOs is that you don’t need a certain amount in the bank to become an angel investor. In fact, it’s in the interest of the cryptocurrency to have a large distribution of investors that each control a small amount of currency. This means the network remains more secure because no single entity can control the whole network.

At least, this is how the model is supposed to work.

The reality is that a large number of the major cryptocurrencies in circulation right now have a very disproportionate spread of wealth. Bitcoin is possibly one of the worst examples of this.

The early adopters

Due to the meteoric rise in the value of Bitcoin over the past few years, those that acquired bitcoins in the early days have become incredibly rich, creating a huge divide between the early adopters and newcomers to the currency. At the time of writing, there are well over 10,000 individuals (or at least individual addresses) that hold over $1,000,000 worth of bitcoin (source).

You can actually take a look at the current “Bitcoin rich list” to see which addresses hold the most of the cryptocurrency. On top of that, we know that roughly 3.5% of Bitcoin owners own over 95% of all the bitcoins in circulation (source). That’s an alarming statistic that mirrors the current levels of wealth inequality that we can see within the non-crypto economy.

2. Bitcoin could destroy the planet

Bitcoin relies on a proof of work (POW) consensus system for security. Without getting into the finer details of how this works, I’ll explain how this could theoretically lead to an ecological meltdown. In short, Bitcoin’s proof of work system involves nodes (known as ‘miners’) on the network using the processing power of their computer to solve relatively complex calculations.

These calculations are a core part of how transactions are processed on the blockchain, and ultimately how new coins are ‘mined’. This system prevents malicious attacks on the network.

For someone to hack the blockchain and change data, they need to change every single block in the history of the chain. The processing power needed for this would nearly always be more costly than the potential gain, keeping the currency secure. This is one of the major security measures built into the blockchain and the reason why it has been so successful so far.

That being said, there are a number of different consensus systems that can be used to achieve the same outcome. One is proof of stake (POS), which requires the node to stake a number of their own assets (coins) instead of providing proof with processing power. There is also proof of space, which involves providing an amount of memory or disk space as opposed to processing power (plus many more).

The “difficulty” dilemma

There are even more complexities within the proof of work system that Bitcoin uses that relate to its “difficulty”. “Difficulty” relates to how complex the calculation is that has to be performed by a node.

As time goes on, difficulty incrementally rises, which means that more processing power is needed to process every transaction on the Bitcoin blockchain. On top of this, as Bitcoin becomes more popular, more individuals are becoming part of the network and supplying hashing power to it (that is, using their own computer’s processing power to support the network).

In the past two years, the “difficulty” has increased by 2,016% and the total hashrate on the Bitcoin network has increased by 1,807%. These are huge increases that have a significant impact on the environment. The sheer amount of energy involved in processing transactions has grown dramatically, and will only continue to grow — a concern that calls into question the long-term scalability of the Bitcoin network.

A study from Digiconomist in October 2017 showed that the power used to process a single Bitcoin transaction could power the average house for a whole week. This kind of power consumption is clearly unsustainable from an environmental point of view.

This doesn’t mean that Bitcoin is unsustainable, as it’s possible that the consensus system is changed or at least modified. But it’s clear this issue is worth paying close attention to.

3. Bitcoin is too slow and expensive

Initially, Bitcoin was being heralded as the next greatest payment system. One that had promise to revolutionize the way we sent money and disrupt all the major players in the space right now, from Western Union through to PayPal.

One of the flagship promises were the extremely low transaction fees and the speed at which you could send and receive funds.

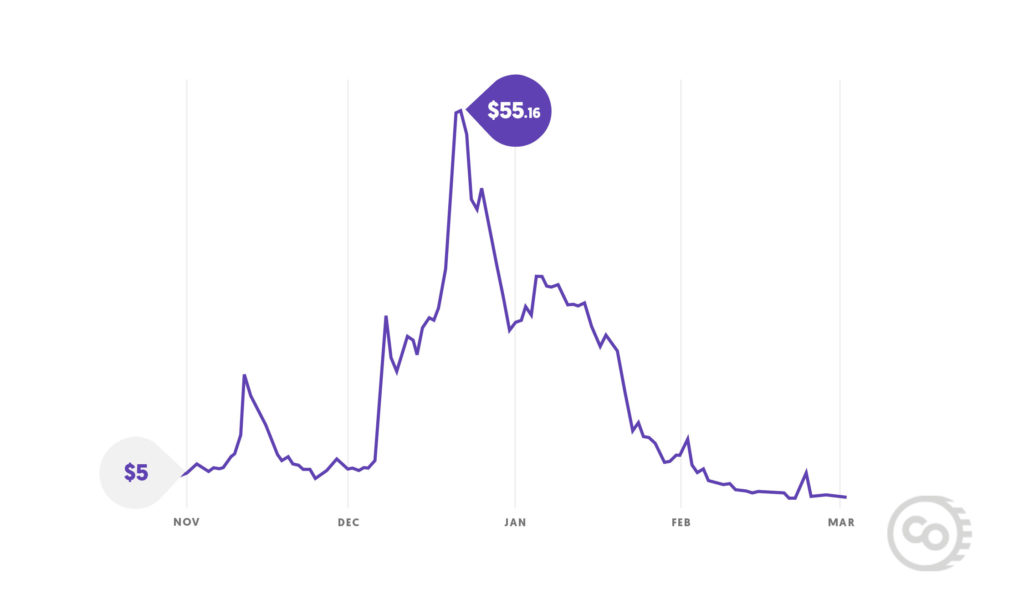

Things have changed a lot since then. In late 2017, transaction fees skyrocketed, rising from an average of $0.213 per transaction on November 8th 2016, to $19.198 on November 12th 2017 (source). That’s an enormous rise in just 12 months, and it means Bitcoin can barely compete with PayPal, let alone any other cryptocurrencies. In fact, the average Bitcoin transaction fee went on to hit an all-time high of $55.16 on December 22nd.

For some further perspective here, the average transaction fee for a DASH transaction on November 8th 2017 was $0.0302 (source).

Not only have the transaction fees exploded, but the average time it takes to confirm a transaction has been increasing too. In late 2017, there were sustained periods where the median confirmation time for a Bitcoin transaction was over 20 minutes (source).

It’s also worth noting here that many wallets require a Bitcoin transaction to be confirmed multiple times before funds are received. As a result, it’s not unusual to have to wait an hour to actually receive bitcoins. If you compare that to the average time a block was confirmed with Litecoin — around 2.5 minutes (source) — Bitcoin begins to seem very slow.

If it’s not viable for Bitcoin to be used for payments, then it’ll likely be used primarily as a store of wealth. The question is, will that give the currency enough utility to stand the test of time?

Now, one huge caveat here is the rise of the Lightning Network which is already showing a lot of promise at reducing fees and increasing speed on the Bitcoin network. It’s early days right now but the initial rollout has a lot of people feeling optimistic that this can solve this problem in the long term.

4. Security and control

As I discussed within, The distribution dilemma, Bitcoin’s apparent decentralized spread of wealth seems to be a lot more centralized than many people realize. Similarly, the distribution of hashing power (that is, processing power using within mining) across the network is becoming even more centralized.

This has far graver consequences than the unequal distribution of wealth.

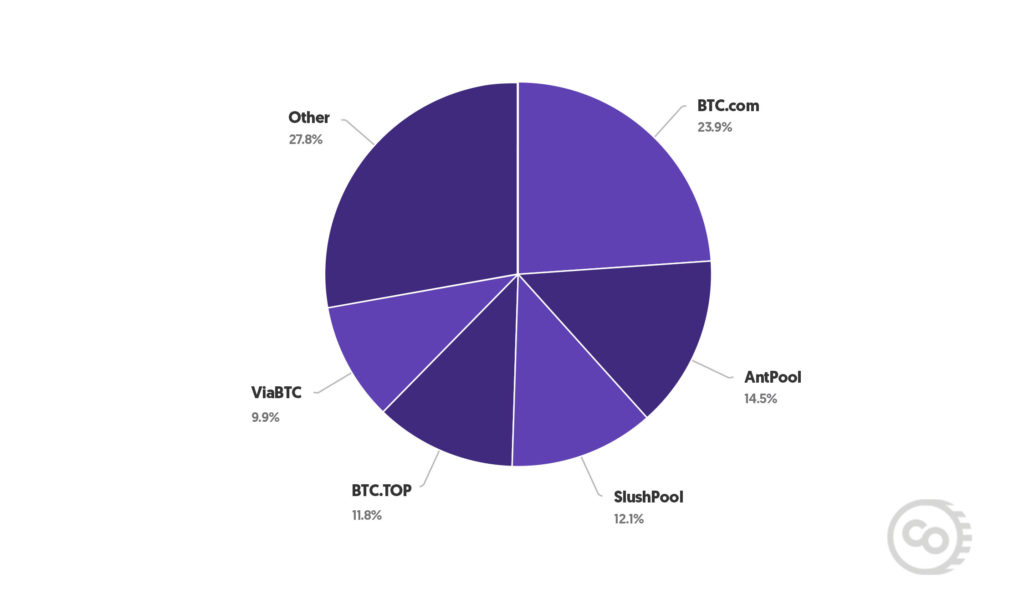

When large corporations, provide the majority of the hash power across the network, this actually gives those entities a disproportionate amount of power and control. As of March 2018, BTC.com controls 23.9% of the total hash power of the Bitcoin network, whilst AntPool controls 14.5% and viaBTC controls 9.9% (source).

What makes this even more alarming is that AntPool, viaBTC and BTC.com are actually all owned by Bitmain, a Chinese for-profit company. In fact, well over 70% of the hashpower on the Bitcoin network comes from China.

Even if the intentions of the major players within Bitcoin mining are good and honest, this still puts a disproportionate amount of risk on the network.

On a basic level, it exposes Bitcoin to regulatory changes within China. If the Chinese government were to shut down all Bitcoin mining operations in the country, that could have catastrophic consequences for the cryptocurrency. Another fear for a lot of up-and-coming cryptocurrencies, as well as Bitcoin, is the threat of a 51% attack, also known as a “majority attack”.

A majority attack can take place on a blockchain when an attacker owns a large proportion of the network hashrate. The attack can be deployed in a number of different ways, but here are two examples of how it could theoretically work:

Selfish mining

Selfish mining is when an attacker privately mines blocks at a faster rate than the rest of the network, and then forks the network to their version of the chain. This renders all the work carried out by the rest of the network useless and enables the attacker to take all the block rewards.

Let’s break this down a little more.

When a new block is discovered on the blockchain, miners use their computational power (hashrate) to find a solution to the complex mathematical problem posed to them via the proof of work consensus system.

When a miner (or pool of miners) finds a solution to a new block, it’s opened up to the network for hashing and the next block appears in the chain.The network must remain on one continuous chain of blocks, so two chains cannot exist at the same time. The network determines which miner solved the problem first and makes that part of the chain the longest, with all miners’ hashing power automatically being moved to this block.

Here’s where the attack comes in…

While miners attempt to solve the block, an attacker with far superior hashing power finds a solution but doesn’t submit it to the network. Once the attacker has the solution, they begin solving the next block, and then the next block, and so on, attempting to get as far ahead as possible. As soon as a miner eventually publishes their solution to the first block, the attacker publishes their hidden solution, forking the network in the process.

As the network decides which miner solved the problem first, the attacker publishes the solution to the second block, making it the longest chain and ultimately the most legitimate. If this happens, the attacker can then go on to continue to publish solutions to the following blocks, gaining all of the mining rewards and removing the ability for anyone else to discover blocks.

This would be very bad.

For a more detailed overview of this whole concept, I’d recommend reading through the detailed paper “Majority is not Enough: Bitcoin Mining is Vulnerable” by Ittay Eyal and Emin Gün Sirer.

Double spending

Double spending works in a similar way to selfish mining but involves the attacker gaming the system so they’re able to spend the coins they’ve already spent again.

They can do this if they own a majority share of the hashing power on the network, as they will be the one verifying the transaction they created. This gives them the power to spend coins within a transaction and then overwrite that transaction after it’s been confirmed through selfish mining.

Similarly to selfish mining, this would not be good.

We’re yet to see a majority attack occur on the Bitcoin blockchain, and as the overall network hashrate increases, it becomes less economically viable for an attacker to perform one. However, this is a very real threat to smaller networks such as smaller altcoins, and that has already happened.

5. The quantum threat

You may have read some of the headlines claiming that quantum computing will be “Bitcoin’s Final Obituary”, and “Quantum Computers Could Jack Your Crypto Private Key”. Is there any substance to these claims?

Well, in some respect, yes.

Is this likely to be Bitcoin’s downfall? It’s unlikely.

To understand the potential threat that quantum computers pose to blockchain technology as a whole, it’s important to understand the encryption currently used to secure Bitcoin data. In order to secure access to their cryptocurrency, the owner generates two alphanumeric strings: a public key and a private key.

A public key is visible to everyone and can be used to send and receive bitcoins. However, if someone has access to your private key, they’ll be able to decrypt your data and access your bitcoins. That being said, it is possible for an attacker to access an account without its private key.

A public key contains a tiny portion of the account’s private key, and a computer can theoretically use this as a starting point to guess the private key through trial and error. However, it’s estimated it would take a conventional computer longer than the time since the universe began to guess a private key using this method (source).

So what’s the problem?

Well, this would be a simple task for a quantum computer. Here’s a short snippet from HowStuffWorks that helps explain why:

“Today’s computers, like a Turing machine, work by manipulating bits that exist in one of two states: a 0 or a 1. Quantum computers aren’t limited to two states; they encode information as quantum bits, or qubits, which can exist in superposition. Qubits represent atoms, ions, photons or electrons and their respective control devices that are working together to act as computer memory and a processor. Because a quantum computer can contain these multiple states simultaneously, it has the potential to be millions of times more powerful than today’s most powerful supercomputers.”

This all sounds quite worrying, but there are a few important things to remember here:

- Quantum computing isn’t a reality yet. Some scientists predict this technology might exist in ten years time. But that is an ambitious target, with a lot of estimates closer to 30 years.

- Simultaneously, cryptographers are working on “quantum resistant” encryption, with lattice-based cryptography, code-based cryptography, and multivariate cryptography being some of the most promising solutions. These quantum-resistant cryptographic technologies could be applied to the Bitcoin blockchain to eliminate the risks posed by quantum computing.

Whether quantum computing is going to pose a real threat to the viability of cryptocurrencies is going to depend on how fast the technology develops. If the current predictions hold true, it’s more than likely that there’ll be solutions in place to deal with it by the time it becomes a reality.

Should I be worried?

This is a question that you may be asking yourself right now. One important component in amongst all of this is the relative infancy of Bitcoin and its accompanying blockchain technology.

In amongst all of the fanfare, enormous price spikes and increased mainstream new coverage, it’s easy to forget that Bitcoin and blockchain technology as a whole are still very new.

Is Bitcoin perfect? No.

Is there one single cryptocurrency with mass adoption that has solved all of the problems listed above? Not yet.

Can Bitcoin adapt and change to tackle these problems in the future? Maybe.

More than anything, I feel that it’s important that we’re asking for solutions now rather than waiting until it’s too late.

Disclaimer: The contents of this article should not be taken as direct investment advice. Please do your own independent due diligence before making any investments, whether this is cryptocurrency or otherwise. Also, the author of this article is a current holder of Bitcoin (BTC).

Leave a Reply